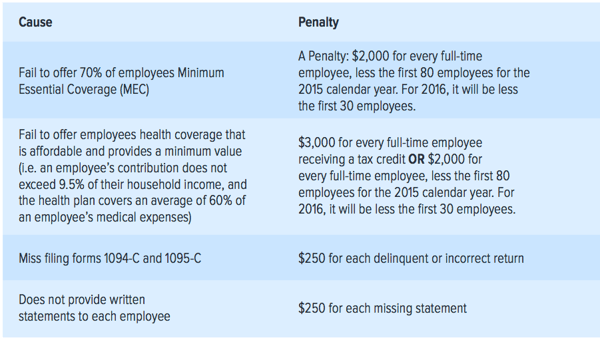

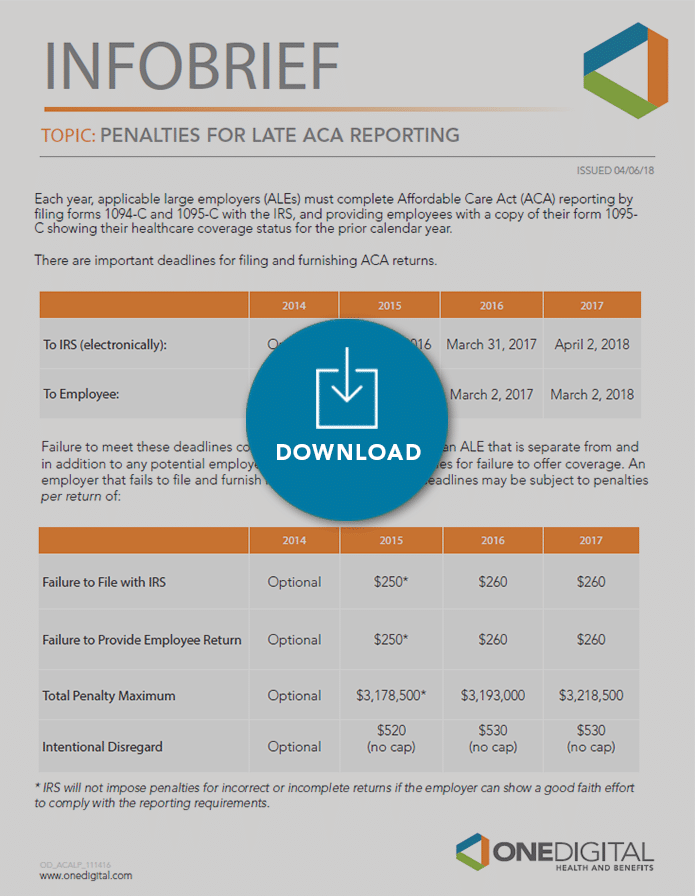

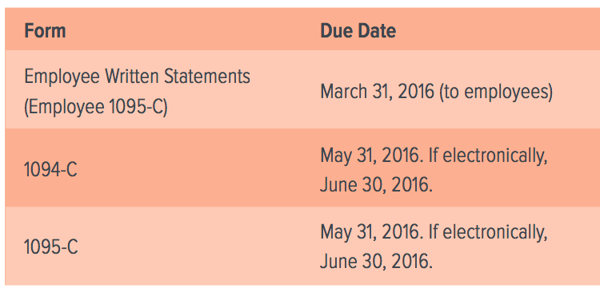

For California purposes, federal Forms 1094C and 1095C must be filed by March 31 of the year following the calendar year to which the return relates Federal Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relates Penalties for late filing are severe Failure to file information returns will result in an IRS penalty of $260/return with a maximum penalty of $3,218,500 per organizationJack's Other Sandwich Shop is an ALE with 80 employees who should each receive a 17 Form 1095C Paychex files Form 1094C and 1095C with the IRS by the April 2 deadline But the company misses the March 2 employee furnishing deadline and is 30 days late in giving Forms 1095C to its employees Even though the IRS forms were filed on time, the company may be

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

1094-c and 1095-c penalties

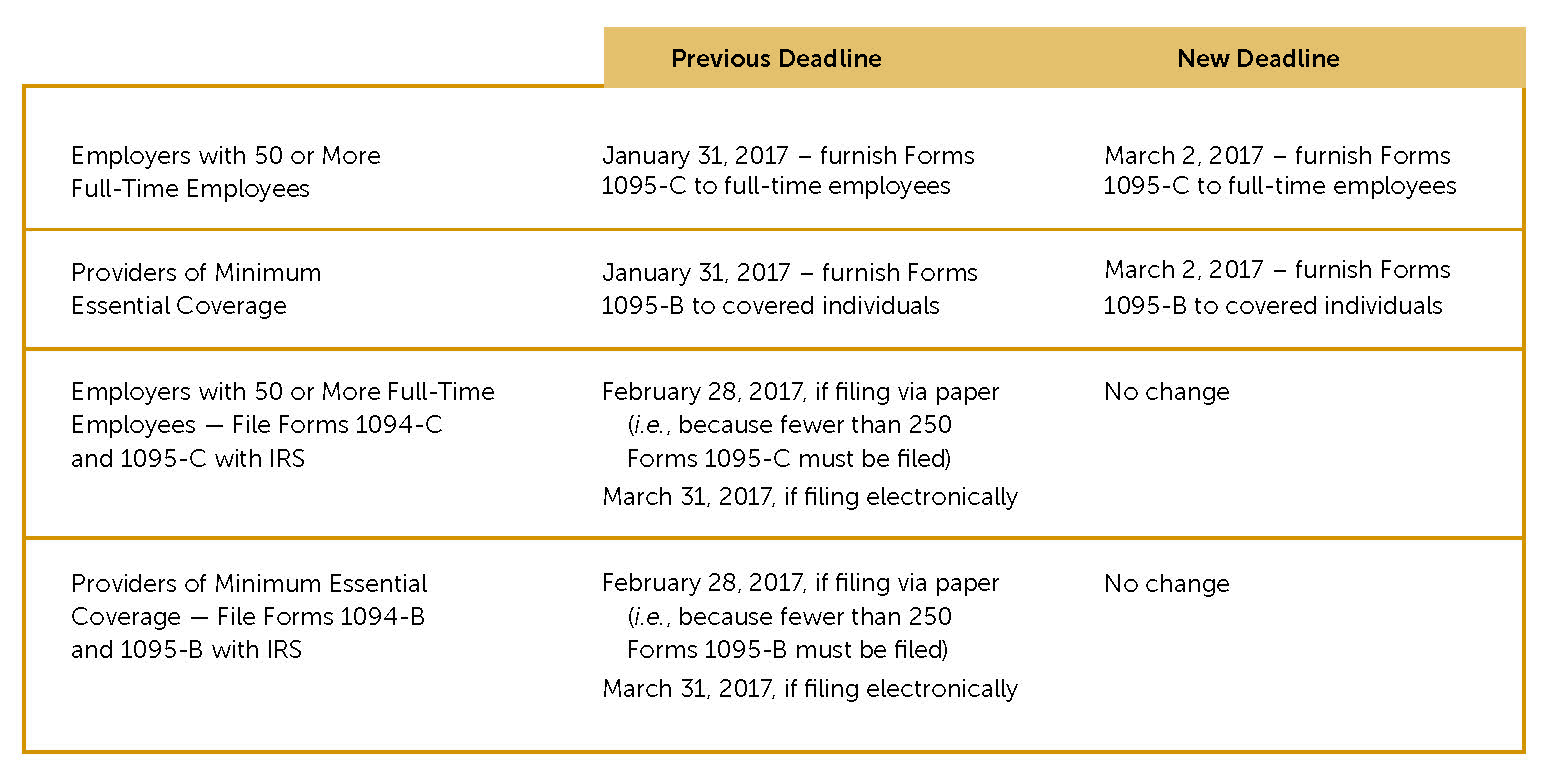

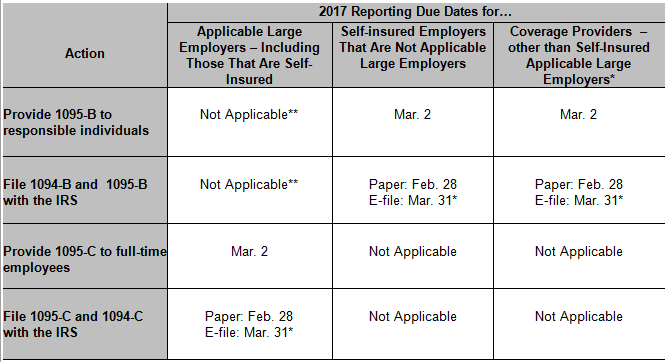

1094-c and 1095-c penalties-Paper filing deadline for Forms 1094C and 1095C to the IRS ; ACA Filing Deadlines and Penalties For ACA reporting, ALEs are required to distribute 1095 forms to its current and past employees by March 2 nd, 21 (extended from Jan 31) ALEs must then file Forms 1094C and 1095C to the IRS by February 28 th, 21 if filing with paper or March 31 st, 21 if filing electronicallyThere is currently no extension for the

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

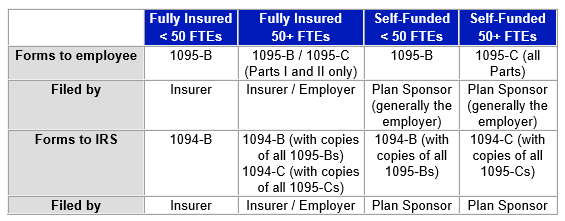

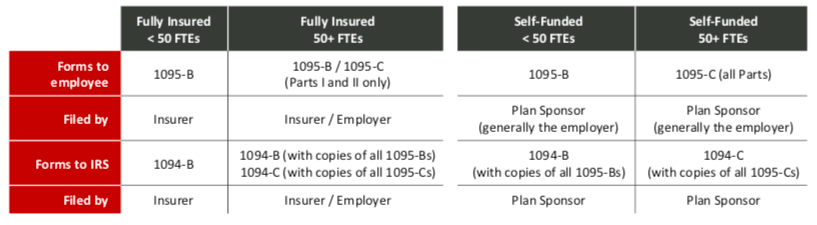

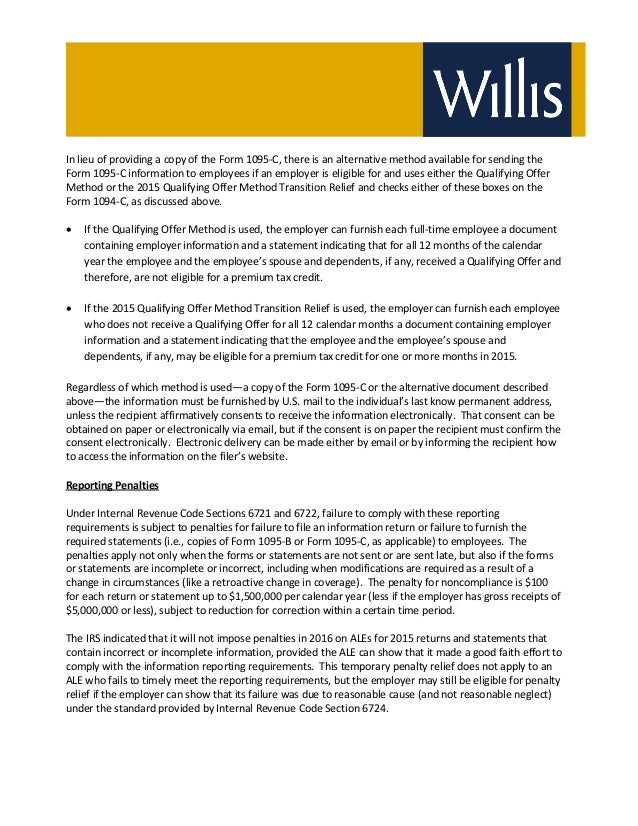

The IRS uses information reported on Forms 1094C and 1095C to determine if an employer owes a penalty for at least one month in the reporting year Each year, applicable large employers (ALEs) must complete Affordable Care Act (ACA) reporting by filing forms 1094C and 1095C with the IRS, and providing employees with a copy of their form 1095C showing their healthcare coverage status for the prior calendar year Let OneDigital help with the details Employers or other coverage providers that do not comply with the due dates for furnishing Forms 1095B and 1095C (as extended under the rules described above) or for filing Forms 1094B, 1095B, 1094C, or 1095C are subject to penalties under section 6722 or 6721 for failure to timely furnish and file, respectively

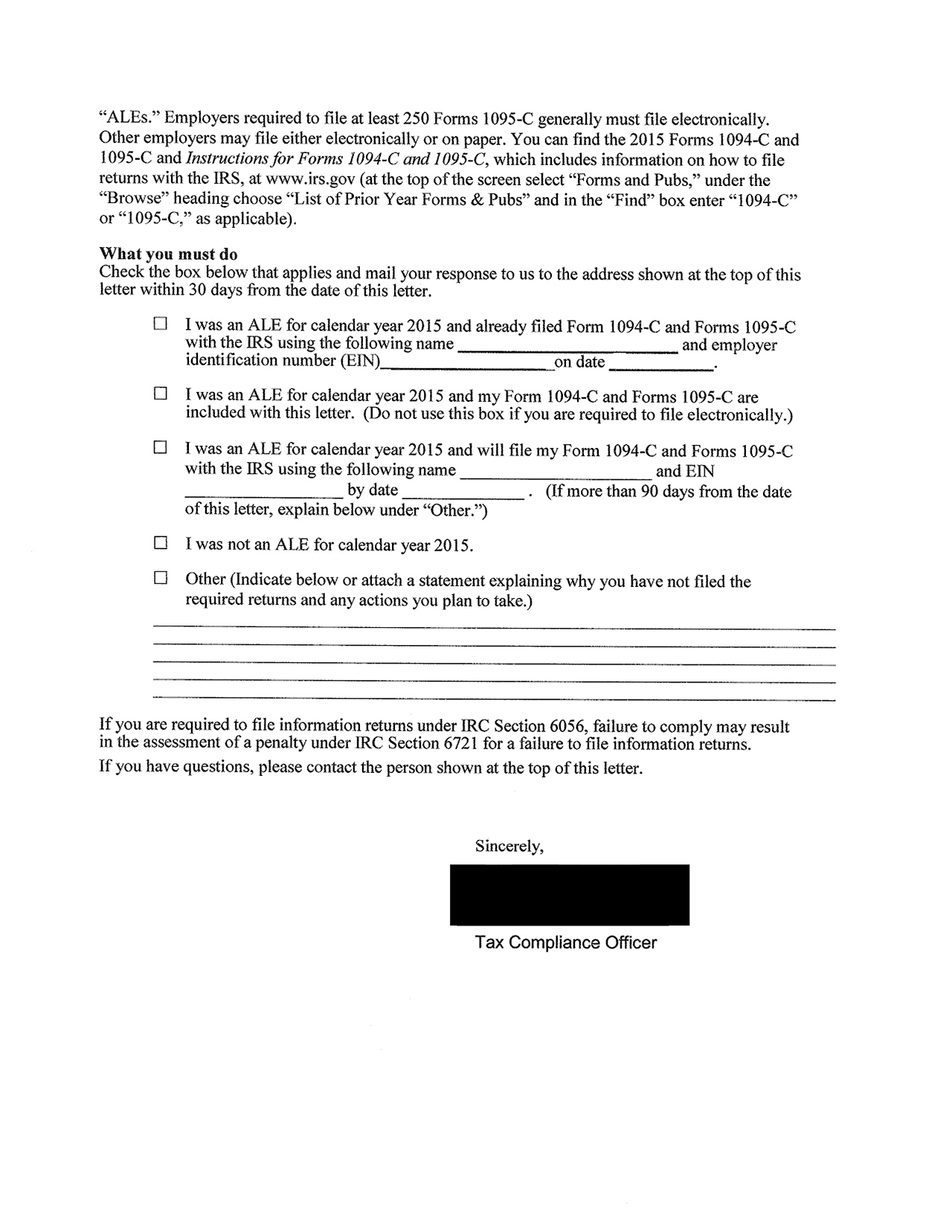

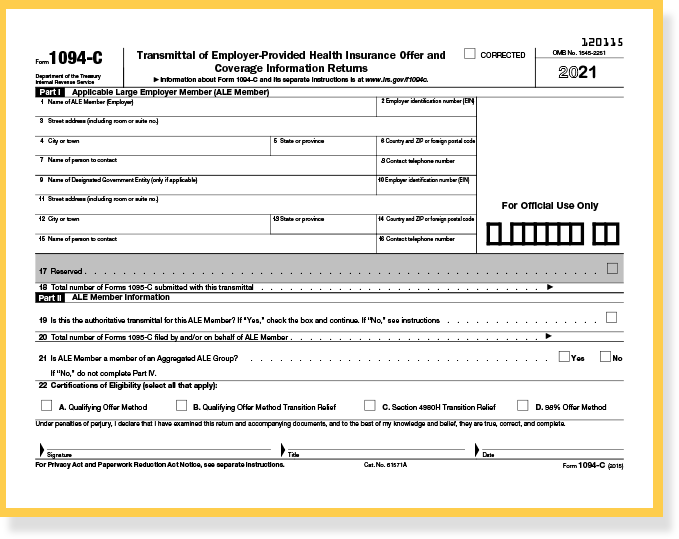

OVERVIEW IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C The IRS has started to issue a new round of ACA penalties that focus on failure to distribute 1095C forms to employees and to file 1094C and 1095C forms with the federal tax agency by required deadlines These are penalties in addition to penalties for not offering the required healthcare coverage Furnishing deadline for Forms 1095C to employees ;

Since the extension relief granted by the IRS through Notice 76 does not extend the due date for filing the Forms 1094B, 1095B, 1094C, or 1095C with the IRS, filers may still request an extension of time for good cause, and the automatic extension remains available under the normal rules for filers who submit a Form 09 on orForm 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C is Accordingly, an employer that has 15,000 employees and intentionally disregards the requirement to file Forms W 2, W 3, 1094 C, and 1095 C faces penalties of up to $15,000,000, calculated as follows 15,000 × $500 = $7,500,000 (failure to file Form W2 transmitted by Form W3)

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Final Forms And Instructions For 19 Aca Reporting Brinson Benefits

Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit If a Form 1094C or 1095C filed electronically is corrected within 30 days of the required filing date, that is, if it is corrected by for 15 filings, the penalty for each violation is reduced to $50 with a maximum penalty of $529,500 per employerForm 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirement

The Irs Is Issuing Penalties For Not Providing 1095 C Forms By Irs Deadlines Update The Aca Times

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

1095 – C is like a W2 Each employee must receive a 1095C from the employer and a copy is also submitted to the government 1094C is like a W3 Aggregate of all 1095C data This file is submitted either electronically or via mail to the government First 1094C Filing is (March 31st if filed electronically) The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish for the 19 tax year The 1094C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095C forms The accompanying 1094C form is simply a new form and the data on it should reflect what is being submitted with it (eg, if 1 form needs correcting, Line 18 on the 1094 form will state "1" even

Aca Filing Services 6055 Reporting Form 1094 C

Www Hendersonbrothers Com Wp Content Uploads 16 11 New Irs Draft Instructions For 1094 C And 1096 C Forms Pdf

Late Filing/Furnishing Penalties Late filing penalty is $250 per return (eg, per 1095C), to a maximum of $3,000,000 per year There is a lower cap (only $1,000,000, not $3,000,000) for smaller entities with gross receipts of not more than $5,000,000 However, these amounts are reduced if late or nonfilings are corrected by the following datesThe penalty for failing to furnish forms to employees has increased from $260 to $270 per return Updated ACA penalties for Meeting ACA reporting requirements is critical and missing deadlines is costly Potential penalties exceed six figures, even for small businesses Large business ACA penalties (gross receipts exceeding $5 million) IRS requires applicable large employees' group health coverage information to enforce the affordable care act and individual mandates ALE provides this information on 1094C and 1095C forms Filing these forms correctly is important for ALE In case of providing incorrect information, they may be subjected to penalties

Update Employer Penalty And 1094 C 1095 C Reporting

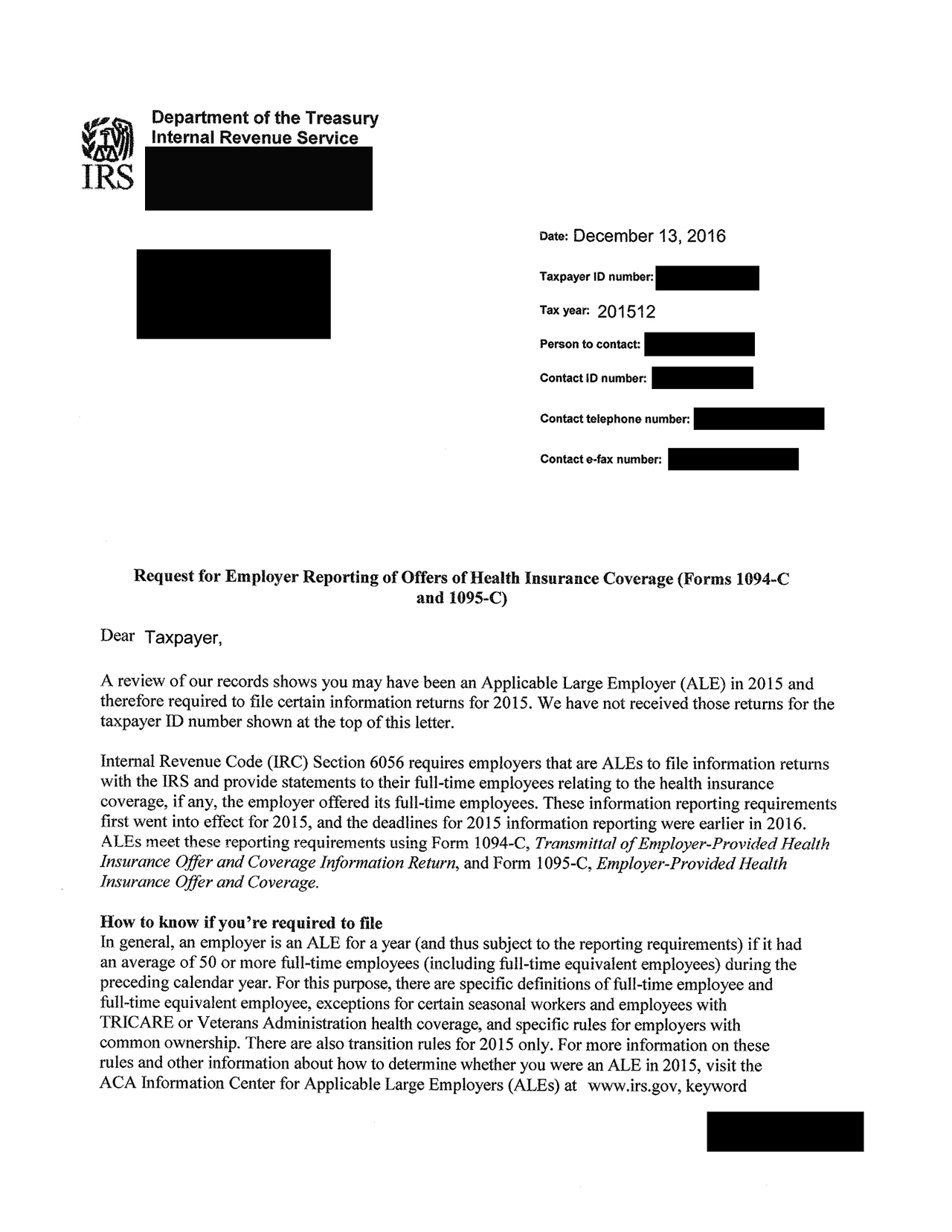

Aca Penalties On The Way Irs Letter 5699 Requests Missing Info

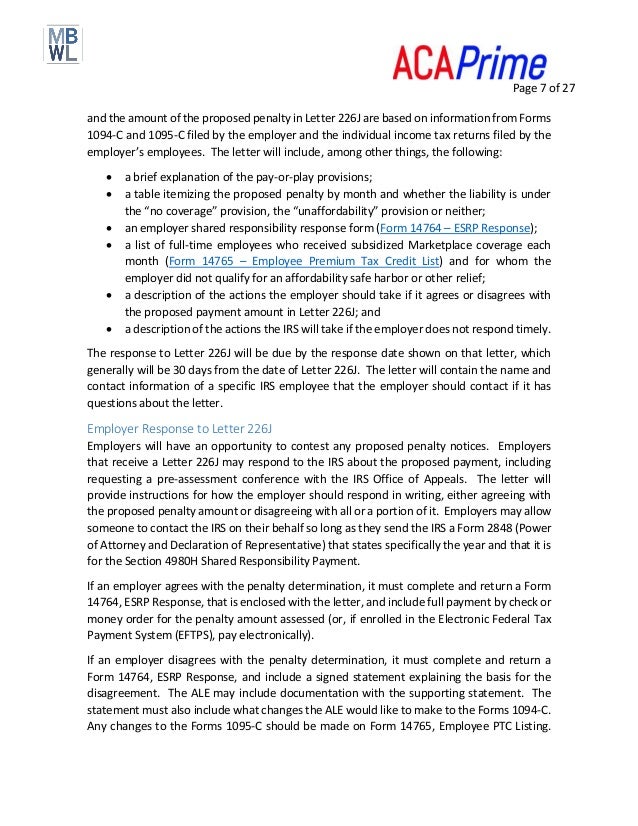

For Forms 1094C and 1095C filed late but within 30 days of the due date, the IRS may impose a penalty of $50 per information return up to a maximum penalty of $565,000 Applicable large employers (ALEs) that submitted Forms 1094C and 1095C should correct any errors as soon as possible to avoid possible penalties All ALEs are required to use these forms to report information about group health coverage, regardless of whether they "play or pay" in accordance with the Affordable Care Act's Employer Shared Responsibility provisions Employers with outstanding errors, should correct Forms 1094C and 1095C for any open tax years (within three years of the filing due date) and should discuss any outstanding issues with their legal counsel What errors trigger the IRS to send a 226J letter?

Irs Reveals Few Changes For Forms 1094 C 1095 C Blog Medcom Benefits

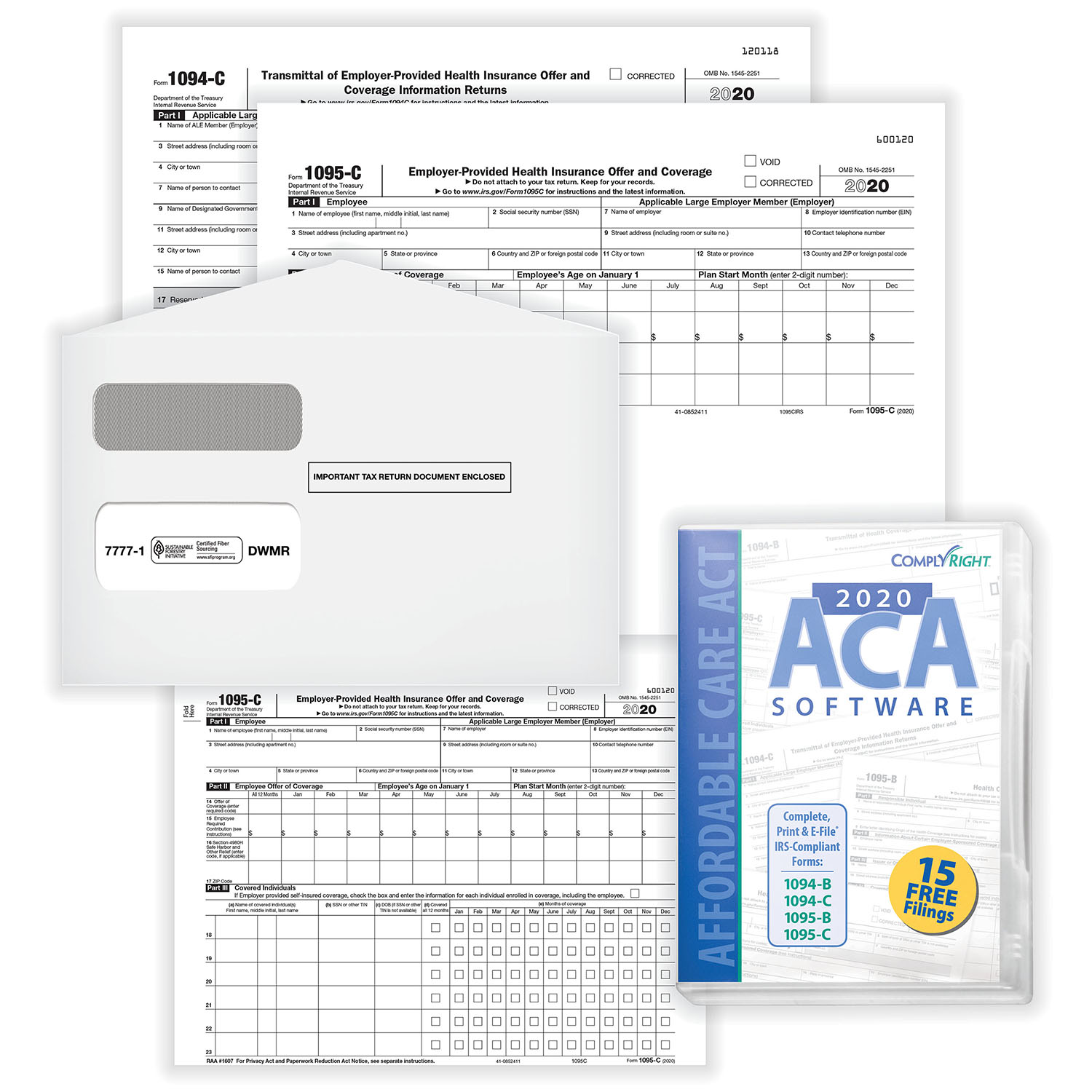

Tax Form Preparation Software 1095 C Software To Create Print And E File Forms 1094 C 1095 C

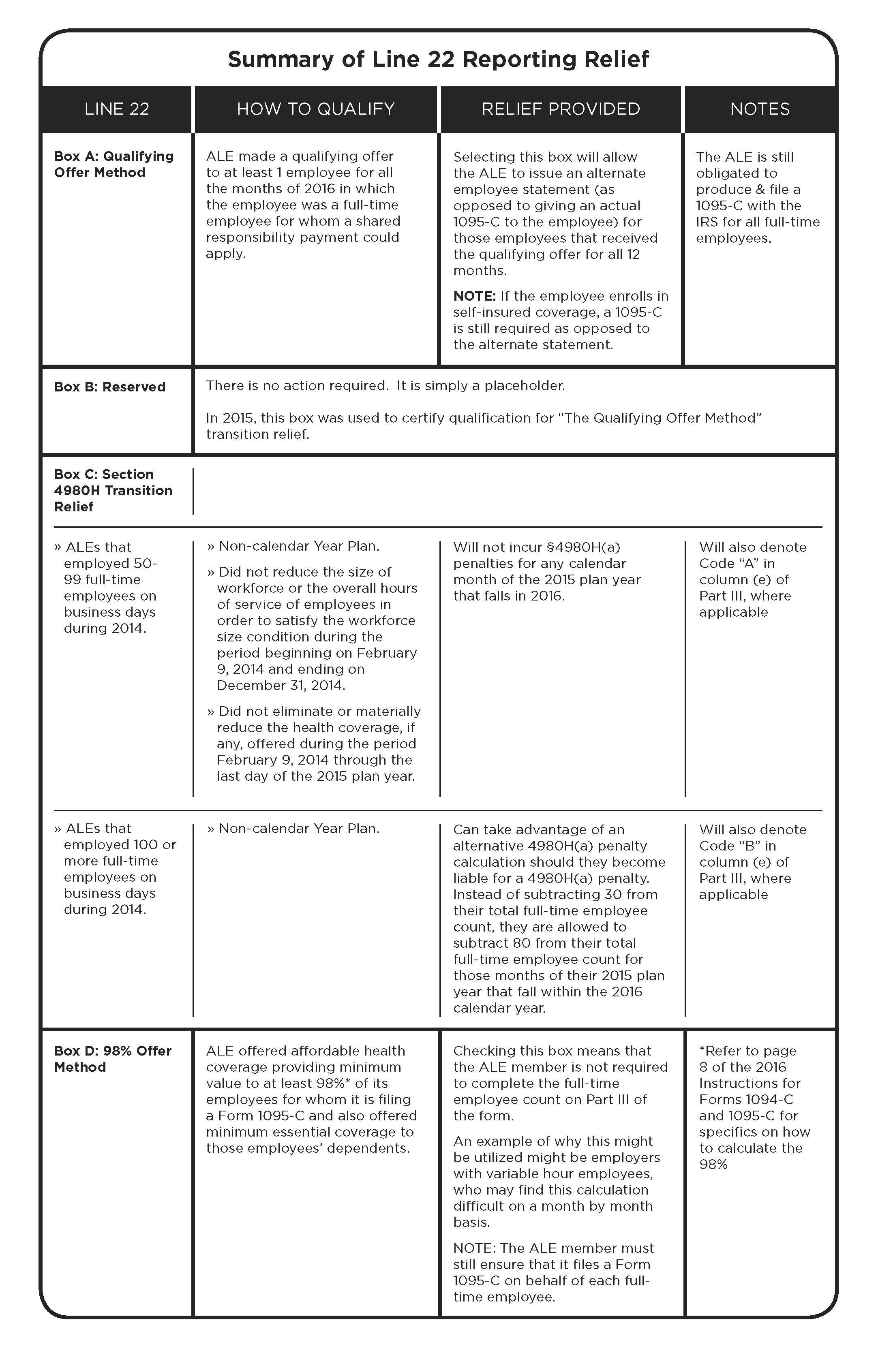

1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employeesThe IRS is using information from 15 Forms 1095C and 1094C, and information about employees who received a Marketplace subsidy for any month in 15, to determine which ALEs it believes are liable for penalties It appears that a Form 1095C on which line 16 is blank is one of the triggers the IRS is using to identify ALEs for penalty noticesThese penalties are being administered under IRC 6721/6722 and this is the first year the IRS has begun issuing such penalties The proposed penalty assessments for failing to file (or filing incorrectly) the C forms, or for failing to provide employees with the 1095C form, are indexed each tax year The following link highlights the

2

Q Tbn And9gcsj2fd0y5g6r8mt9bhze7eiq3dikiuy6ur5pdhj7m9zdqnm8y O Usqp Cau

An IRS AIR TCC is required to file information returns 1094B, 1095B, 1094C and/or 1095C See the Account Ability Help menu for instructions on how to apply for an ACA TCC ("Application for ACA TCC Instructions")Not counting your employees properly Penalties are based on the stated fulltime employee counts for each month of the tax year as provided on Form 1094C Make sure you are17 Form 1095C (employee statement) Due 17 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) The 18 forms (ie, forms reporting calendar year 18 information) are due as follows 18 Form 1095C (employee statement) Due

Mbwl Employer S Guide To Aca Reporting Updated For 17 Season

Irs Memo Concludes There Is No Statute Of Limitations For Aca Employer Mandate Penalties Under Internal Revenue Code 4980h Workforce Bulletin

Forms 1095C are filed accompanied by the transmittal form, Form 1094C An ALE Member can provide the required statement to the employer's fulltime employees by furnishing a copy of the Form 1095C filed with the IRS Alternatively, these returns and employee statements may be provided by using substitute forms Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirementMarch 31 Deadline for electronic filing to the IRS;

United Benefit Advisors Home News Article

1

Many Letters 226J are the result of mistakes in filling out the Forms 1094C or 1095C The penalties are levied based on the information provided by employers on their 1094C and 1095C forms Section 4980H (a) A penalty will be levied on an employer if Minimum Essential Coverage (MEC) is not offered to at least 95% of their fulltime employees and if any employee receives a Premium Tax Credit (PTC) through the marketplaceShort Answer The general ACA reporting penalties are $280 for the late/incorrect Forms 1095C furnished to employees, and $280 for the late/incorrect Forms 1094C and 1095C filed with the IRS That comes to a total potential general penalty of $560 per employee, but exceptions may apply ACA Reporting General Rule

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Late Or Inaccurate 1095 Cs Or Bs Consider The Penalties Leavitt Group News Publications

The Statute of Limitation and the Section 6721 Penalties However, the IRS extended goodfaith transition relief from penalties to ALEs for incorrect or incomplete information on 1094C/1095C for the 15 through tax filing year, similar to the extension they provided during the 19 tax filing season The IRS indicated that the tax year is likely to be the last year for goodfaithForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C also is used in determining the eligibility of employees for the premium tax credit

The Scoop On The New Aca 1094 C And 1095 C Forms

The Irs Aca Audit Has Begun What To Do To Avoid Penalties The Aca Times

Form 1094C This is used by applicable large employers ("ALEs") to report whether the employer offered minimum essential coverage and to transmit the employee statements (Form 1095C) to the IRS Form 1095C Finally, this form is used by ALEs to report certain statutoryrequired information to employees about their employersponsored health coverage January 31 Deadline to furnish Form 1095C to employees;The due date for filing Forms 1094C and 1095C with the IRS is February 28th, 21 if filing by paper, and March 31st, 21 if filed electronically ACA Penalties for Late Filing (Small Businesses) The penalties range from $50$530 per missed ACA

1094 C 1095 C Audit Can Prevent Irs Aca Penalties The Aca Times

The Irs Wants To Know Has Your Company Filed Form 1095 C

As summarized above, employers should correct errors on Forms 1094C and 1095C, enter "X" in the CORRECTED checkbox and refile the form with the IRS The vendor you used to file electronically should be able to provide direction for this process Furnish corrected Forms 1095C to affected individuals as soon as practicable Penalties The premium tax credit information necessary to enforce either penalty under IRC section 4980H is not reported anywhere on the Forms 1094C and 1095C Therefore, filing the Forms 1094C and 1095C with the IRS does not start the statute of limitation clock In fact, nothing does! In addition, ALEs will need to properly file transmittal Form 1094C, along with the Forms 1095C s to avoid incurring penalties In addition to serving as a transmittal form, the ALEs also use Form 1094C to demonstrate compliance with the requirement to offer Minimum Essential Coverage to at least 95% of their fulltime workforce

Www Americaninsuranceid Com Faq Blog 3492 Aca Employerreportingrequirements 15 Pdf

Penalties Doubled For Faulty Aca Reporting

Penalties due to late filing of the 1094C and 1095C or failure to furnish forms to employees might be waived if a company provides "reasonable cause" (circumstances beyond a filer's control) Also, the filer must have made a reasonable attempt to file before and after late filingMaximum penalty for late or nonfiling/furnishing increases for inflationary adjustments There is a reference toWhen assessing whether an employer may be subject to a shared responsibility penalty, the IRS uses an employer's Forms 1094C and 1095C, as well as employees' income tax returns Based on this information, if the employer does not report an applicable safe harbor and the employee received subsidized coverage, then the letter will be issued

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

The Irs Aca Audit Has Begun What To Do To Avoid Penalties The Aca Times

Letter 5005A is the penalty notice that follows the IRS' Letter 5699, which is sent to employers that the agency believes are Applicable Large Employers that failed to file and or furnish the required ACA forms 1094C and 1095C as required under IRC sections 6721/6722 Penalties continue to increase annually as this is a multibillionElectronic filing deadline for Forms 1094C and 1095C to the IRS ;Note §6055 reporting via Forms 1094B and 1095B will apply if the employer offered a selfinsured medical plan Employer is subject to potential pay or play penalties (under §4980H) in 21 Employer is subject to ACA reporting (§6055/ §6056 via Forms 1094C and 1095C) for the 21 calendar year that is reported at the

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

2

February 28 Deadline to file Forms 1094C/1095C to the IRS if filing by paper;

Aca Reporting On 1094 And 1095 B And C Getting A Jump On Upcoming Deadlines And

2

Aca Penalties Archives Sbma Benefits

Aca Compliance Filing Deadlines For The 18 Tax Year

How To Accurately Complete Lines 14 16 On Irs Form 1095 C

Affordable Care Act Lessons Learned Ppt Download

Aca Deadlines Penalties Extension For 21 Checkmark Blog

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Irs Delays The Deadline To Furnish The Aca Forms 1095 C And 1095 B To March 2 17 And Extends The Good Faith Transition Relief From Reporting Penalties Trucker Huss

3

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Www Alliantbenefits Com Media 1345 Alert 17 11 Amended Filings In The Era Of Esr Penalties Pdf

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Affordable Care Act Form 1095 C Form And Software Hrdirect

Http Lambbarnosky Com Wp Content Uploads 15 12 Client Memo Attachment Aca Pdf

Need To Correct An Irs 1094 C Or 1095 C Form

What Cpas Need To Know About New Ppaca Forms

1

Section 6056 Large Employer Reporting Ts1099 Ts1099

Your 1095 C Obligations Explained

Irs Form 1095 C Codes Explained Integrity Data

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

Employer Reporting Forms 1094 C And 1095 C Hays Companies

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Correcting Errors Reported By The Irs Is Just As Important As Filing

Aca Jolt Irs Non Filing Fine Up To 550 Per Required 1095 C In Integrity Data

Irs Releases Final Forms And Instructions For 17 Aca Reporting Brinson Compliance Brinson Benefits

The Irs Is Issuing New Aca Penalties Against Employers Accounting Today

Updated Irs Reporting Requirements Babb Insurance

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Avoid Common Errors This Aca Reporting Season Health E Fx

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Irs Announces Relief For Certain Form 1094 1095 Reporting Requirements Mcafee Taft

News Detail Njtma Nj Technology Manufacturing Association

Affordable Care Act Reporting Update Benefit Minute Psa Insurance And Financial Services

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

The Individual Mandate May Be Going Away Next Year But Employers Are Still On The Hook For 1094c 1095c Reporting Usi Insurance Services

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits

Irs Releases Final Forms And Instructions For 19 Aca Reporting Bim Group

Irs Releases Draft Forms And Instructions For 19 Aca Reporting Michigan Benefits Agency Strategic Services Group Ssg

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Affordable Care Act Reporting Requirements Presented By Winston

Aca Reporting Penalties Newfront Insurance And Financial Services

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Irs Form 1095 C Codes Explained Integrity Data

Irs Extends Good Faith Penalty Relief And Due Date For Furnishing 18 Forms 1095 B And 1095 C To Individuals But Not For Filing With The Irs

Aca Employer Compliance In 6 Easy Steps

Irs Releases Draft Forms And Instructions For 17 Aca Reporting Brinson Compliance Brinson Benefits

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

18 1095 Deadline Extended From Jan 31 To March 4 Leavitt Group News Publications

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Missed The 1095 C Deadlines Now What Onedigital

Www Irs Gov Pub Irs Prior Ic 17 Pdf

Common Mistakes In Completing Forms 1094 C And 1095 C

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

File Aca 1094 C 1095 C Information With Irs On Time To Avoid Penalties The Aca Times

How To Avoid Irs Penalty Fees For Forms 1094 C 1095 C The Aca Times

How To Correct Form 1094 1095 Errors The Cip Group

News Flash September 5 14 Irs Releases Draft Pay Or Play Informat

Your Complete Guide To Aca Forms 1094 C And 1095 C

Aca Employer Compliance In 6 Easy Steps

Www Efile4biz Com Downloads Aca Reporting Simplified Pdf

Aca Reporting 1095 C The Insurance Exchange

Aca Alerts The Benefit Companies

Aca Jolt Irs Non Filing Fine Up To 550 Per Required 1095 C In Integrity Data

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Fedeli Group

Irs Issued Notice 16 4 Extending The Due Dates For Forms 1094 C And 1095 C For 15 Mnj Insurance Solutions

For 17 Tax Year The Irs Is Issuing Aca Penalty Letter 5005 A

0 件のコメント:

コメントを投稿